Studying abroad is one of the biggest investments you will ever make in your future. It opens doors to global education, international careers, and life-changing experiences. But behind the excitement lies one unavoidable reality: money that is how to budget for study abroad.

Many students dream of studying abroad but never make it—not because they lack admission, but because they underestimate the true cost. Tuition is just the beginning. Accommodation, travel, food, insurance, visa fees, and everyday living expenses quickly add up. Without a clear and realistic budget, students risk financial stress, visa refusal, or even dropping out mid-program.

This guide is designed to help you budget smartly and confidently. Whether you’re planning to study in Europe, the UK, Canada, or the USA, this article breaks down tuition, accommodation, travel, and hidden costs, with practical tips to help you stay financially prepared from application to graduation.

Why Budgeting for Study Abroad Is Non-Negotiable

Budgeting is not just about saving money—it’s about survival and success abroad.

A proper study abroad budget helps you:

- Choose a country and university you can truly afford

- Meet visa proof of funds requirements

- Avoid debt and financial emergencies

- Focus on academics instead of money stress

- Plan long-term, not just for your first semester

Many embassies reject student visas due to insufficient or poorly explained funds. A detailed budget shows that you understand the financial commitment and are ready for it.

👉 Also Read: “Proof of Funds Requirements for Student Visas”

Understanding the True Cost of Studying Abroad

Before creating a budget, you must understand what you’re budgeting for. Study abroad costs fall into two categories:

1. One-Time Costs

- Application fees

- Tuition deposits

- Visa fees

- Flight tickets

- Initial accommodation deposit

2. Recurring Costs

- Tuition (per semester or year)

- Rent

- Food

- Transportation

- Utilities

- Insurance

A mistake many students make is planning only for tuition while ignoring everyday living costs.

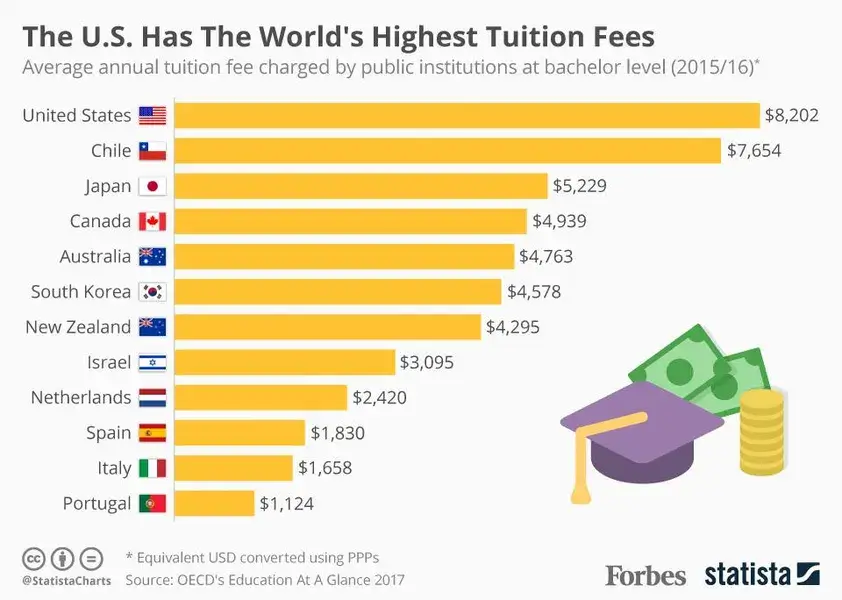

Tuition Fees: The Foundation of Your Study Abroad Budget

How Much Is Tuition for International Students?

Tuition fees vary widely depending on:

- Country

- University (public vs private)

- Course of study

- Degree level

Average Annual Tuition by Destination

- Germany: €0 – €3,000 (public universities)

- France: €2,770 – €3,770

- Poland/Czech Republic: €2,000 – €6,000

- UK: £10,000 – £25,000

- Canada: CAD 15,000 – 35,000

- USA: $20,000 – $50,000+

Hidden Tuition-Related Costs

- Registration fees

- Student union fees

- Lab or studio fees

- Course materials

Smart Tuition Budgeting Tips

- Confirm if fees are per semester or per year

- Ask about installment payment plans

- Check if tuition increases after first year

- Factor in currency exchange fluctuations

👉 Also Read: “Cheapest Countries to Study Abroad for International Students”

Accommodation Costs: Your Biggest Living Expense

Accommodation is usually the second most expensive part of studying abroad.

Common Student Housing Options

1. University Dormitories

- Cheapest option

- Close to campus

- Utilities often included

2. Shared Apartments

- Moderate cost

- Shared rent and utilities

- More independence

3. Private Rentals

- Most expensive

- Ideal for couples or families

4. Host Family (Homestay)

- Rent includes meals

- Cultural immersion

Average Monthly Accommodation Costs

- Europe: €300 – €900

- UK: £400 – £1,200

- Canada: CAD 500 – 1,200

- USA: $600 – 1,500

Accommodation Costs to Include in Your Budget

- Monthly rent

- Security deposit (1–2 months)

- Utilities (electricity, water, gas)

- Internet

- Furniture

Money-Saving Housing Tips

- Apply early for student housing

- Live outside city centers

- Share apartments

- Ask if utilities are included

👉 Also Read: “Best Student Accommodation Options Abroad”

Travel Costs: More Than Just a Plane Ticket

Many students underestimate travel expenses, focusing only on airfare.

Travel Costs to Budget For

- One-way or return international flight

- Airport transfers

- Local transportation

- Occasional intercity travel

Average One-Way Flight Costs

- Africa → Europe: $400 – $900

- Africa → UK: $500 – $1,000

- Africa → Canada/USA: $800 – $1,500

Monthly Transportation Costs

- Europe: €40 – €100

- UK: £60 – £150

- Canada: CAD 80 – 150

- USA: $70 – 130

Travel Budget Tips

- Book flights 2–4 months early

- Use student fare discounts

- Buy monthly transport passes

- Choose cities with strong public transport

👉 Also Read: “How to Book Cheap International Flights as a Student”

Cost of Living: Daily Expenses That Add Up

Living costs depend heavily on lifestyle and city.

Typical Monthly Living Expenses

- Food and groceries

- Utilities

- Mobile phone and internet

- Personal care

- Entertainment

Average Monthly Living Costs

- Europe: €600 – €1,000

- UK: £800 – £1,200

- Canada: CAD 800 – 1,500

- USA: $900 – 1,800

How to Reduce Living Expenses

- Cook at home

- Buy groceries in bulk

- Use student discounts

- Avoid impulse spending

👉 Also Read: “Cost of Living Comparison for International Students”

Health Insurance and Medical Costs

Most countries require international students to have health insurance.

Average Insurance Costs

- Europe: €80 – €150/month

- UK: Immigration Health Surcharge (IHS)

- Canada: CAD 600 – 1,000/year

- USA: $1,000 – 3,000/year

Failing to budget for insurance can delay enrollment or visa approval.

👉 Also Read: “Best Travel and Health Insurance for Student Visas”

Visa, Application, and Documentation Costs

These are unavoidable but often forgotten expenses.

Typical Costs Include

- Visa application fee

- Biometrics

- Document translation

- Notarization

- Courier services

Estimated Cost Range

- €60 – €250 (depending on country)

👉 Also Read: “Student Visa Application Fees by Country”

Books, Study Materials, and Academic Tools

- Textbooks

- Laptop or tablet

- Software licenses

- Printing and lab fees

💡 Tip: Buy second-hand books or digital versions whenever possible.

Emergency Fund: Your Financial Safety Net

Always set aside 10–15% of your total budget.

Emergency expenses include:

- Medical issues

- Rent increases

- Currency changes

- Unexpected travel

Many students fail abroad not because of tuition—but because they had no emergency buffer.

Sample Study Abroad Budget (Annual Estimate)

| Expense | Estimated Cost |

|---|---|

| Tuition | €10,000 |

| Accommodation | €6,000 |

| Living Expenses | €7,200 |

| Travel | €1,200 |

| Insurance | €1,000 |

| Visa & Documents | €300 |

| Emergency Fund | €1,500 |

| Total | €28,200 |

How to Fund Your Study Abroad Budget

Common funding sources include:

- Personal savings

- Family sponsorship

- Scholarships and grants

- Education loans

- Part-time student jobs

⚠️ Never rely on part-time work to pay tuition—it’s meant for living costs only.

👉 Also Read: “Scholarships for International Students by Country”

Final Thoughts: Plan Early, Study Stress-Free

Budgeting for study abroad is not about being wealthy—it’s about being prepared. When you understand your tuition, accommodation, travel, and living costs clearly, you gain control over your finances and your future.

Start planning early. Budget realistically. Always overestimate slightly. Your study abroad experience should be about growth, not financial panic.

Please let others know that you read this.